Home loan calculators How much can I borrow?

Table of Content

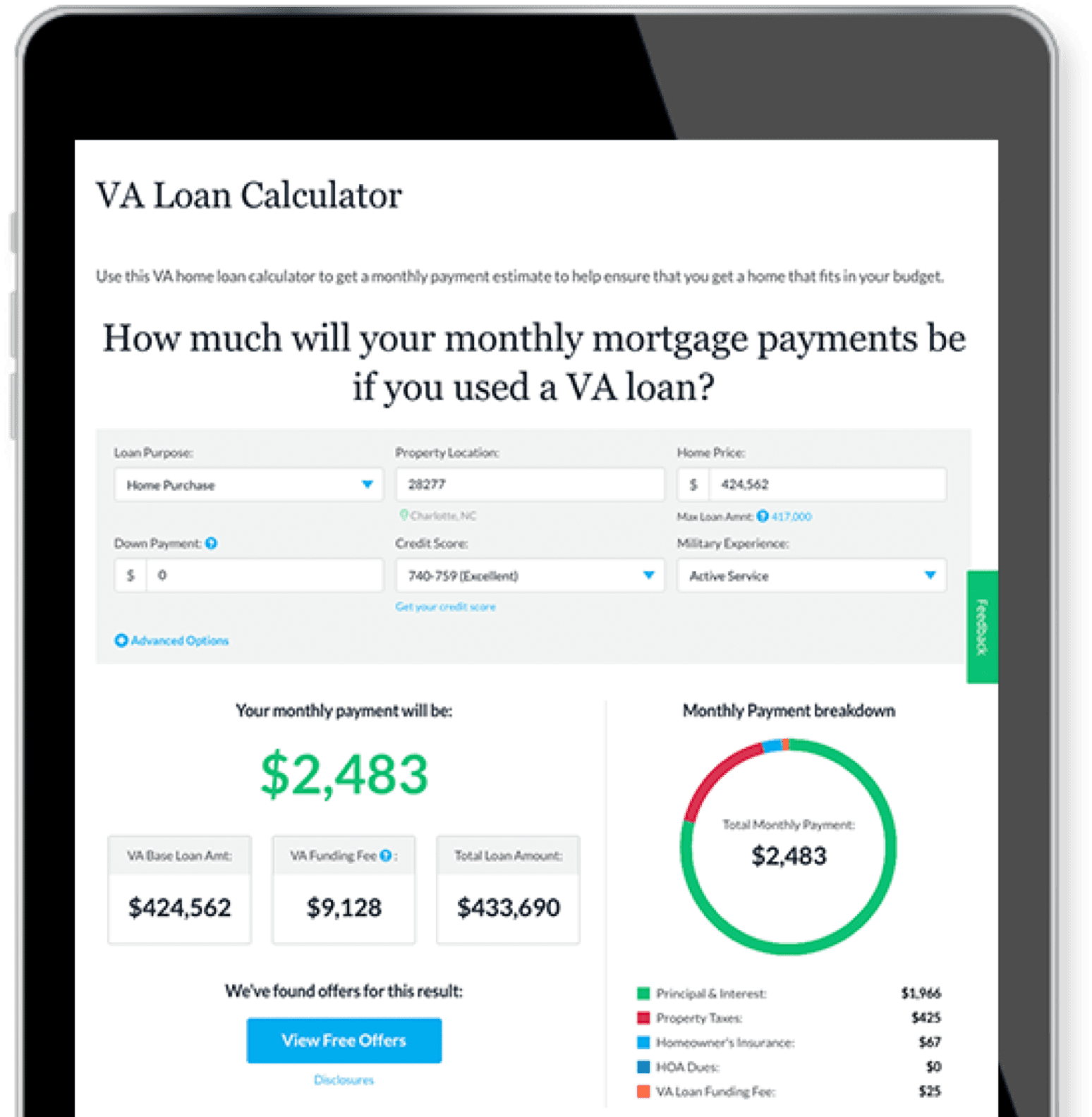

The borrower makes payments to the lender over a set period of time until the loan is paid in full. Our affordability calculator uses the current national average mortgage rate. Your interest rate will vary based on factors like credit score and down payment. To calculate your repayments you need to know what the principal is (the amount you’re borrowing), what the interest rate is and loan term is.

Going down this route could spare you from long-term headaches, especially if turnover rates are fast. But there are risks involved, most notably, that there’s no guarantee that you’ll sell for a profit. The good news is you are allowed to deduct certain property-related expenses from your tax. It is fundamental to understand the property cycle as a property investor.

House price slowdown slashes Aussie’s household wealth

The middle ground could just represent tolerable debt symbolized by 2. Investors often engage in the type 1 obligations since they are expectant of making profits. There are some standard calculations our credit team use to measure the financial impact each dependant can have - these numbers are factored into our home loan calculators. Ask your home loan specialist for more detail about how it's worked out. Employment status can have an influence on your borrowing power, as it might be more complex to demonstrate your income if you’re in this position, and don't always have a regular salary for example.

Bluestone's home loan lending criteria, terms and conditions apply. The Federal Housing Administration is an agency of the U.S. government. An FHA loan is a mortgage loan that is issued by banks and other commercial lenders but guaranteed by the FHA against a borrower’s default. The total of your monthly debt payments divided by your gross monthly income, which is shown as a percentage. Your DTI is one way lenders measure your ability to manage monthly payments and repay the money you plan to borrow.

How much can I borrow?

Start your home loan pre-approval application in just 5 minutesdisclaimeror find out what a property could sell for,disclaimerso you can buy with more confidence. IMPORTANT. The affordability calculator provides only a general estimate, is intended for initial information purposes only, and your use of the affordability calculator is subject to our Terms of Use. Getting the lowest possible interest rate is one of the easiest ways to save on your home loan. If it’s been a while since you’ve checked your interest rate, you could be paying too much. The lower the DTI, the more likely a home-buyer is to get a good deal. Buying with bad creditIf you have bad credit and fear you'll be denied for a mortgage, don't worry.

Work out how much you may be able to roughly borrow with us, based on your income and expenses. Our home loan specialists can help you with pre-approval,disclaimera new home loan, refinancing or topping up your existing home loan. Refinance an eligible home loan to ANZ and you could get cash back.

Aussies set aside bigger share of income for mortgage repayments

The results of these calculators do not take into account loan setup or establishment fees nor government, statutory or lenders fees, which may be applicable from time to time. Lenders mortgage insurance calculator If you’re borrowing more than 80% of the purchase price of a home, you’ll need to pay Lender's Mortgage Insurance . Borrowing power calculator Want to find out much you can borrow for a home loan? Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend you based on your income and expenditure.

This calculator is intended as a guide only and is not to be considered as an offer of finance by Bluestone nor is it a recommendation or opinion in relation to the relevant products. It does not take into account your personal financial situation or goals. Calculated figures are based on the accuracy of the information entered.

Save a bigger deposit

Negative gearing calculator The Negative Gearing Calculator allows residential property investors to see the possible tax benefits of owning a negatively geared investment property. Rent or buy comparison This calculator shows you how your finances will look seven years after buying a home or continuing to rent, allowing you to make an informed decision between the two. They do not reflect comparison interest rates or true interest rates and are based on the assumption that interest rates will remain constant for the terms of the loans you have entered. The formula used for the purpose of calculating monthly repayments is based on daily compounded interest. Loan timeframes and total repayment amounts are calculated through principal and interest servicing.

The younger generation is particularly in constant need for living spaces as they navigate the business world. As a current home owner, you may want to consider using equity you’ve built up, to help buy your next home or investment property. Equity is the difference between your property’s current market value, and what you still owe on your home loan.

Small adjustments can lead to major changes, so testing different options in the mortgage repayment calculator is worth the effort. And while it’s still best to speak to a professional, which you can dofor free here, this calculator is an ideal starting point. You can also try testing our Borrowing Power Calculator to have an idea of how much you can afford to borrow. Saving up a bigger deposit can help you reduce your loan repayment because you’re borrowing less. Obviously this isn’t an option for everyone, particularly if property prices are rising faster than your ability to save a bigger deposit. The front-end debt ratio is also known as the mortgage-to-income ratio and is computed by dividing total monthly housing costs by monthly gross income.

Hobart and Canberra have recorded substantial double-digit gains while Melbourne tops after Sydney with 15.9% annual appreciation. The economic developments in the South-east region are positively promoting the real estate market in the area. Real estate experts note that it is possible to provide house equity as collateral which is important for buyers who cannot come up with the deposit money up-front.

Realtor.com provides information and advertising services – learn more. If your down payment is less than 20 percent of your home's purchase price, you may need to pay for mortgage insurance. You can get private mortgage insurance if you have a conventional loan, not an FHA or USDA loan. Rates for PMI vary but are generally cheaper than FHA rates for borrowers with good credit.

Comments

Post a Comment